California’s automotive landscape in 2024 presented a mixed bag of trends, according to the Year End 2024 California Auto Outlook Report from the California New Car Dealers Association (CNCDA). While the overall new car market remained remarkably stable, significant shifts occurred beneath the surface, particularly in the electric vehicle (EV) sector and the rising popularity of hybrids. This report, using data from Experian Automotive, offers a comprehensive look at New Car 2024 registrations in California and what these trends might signal for the future of the automotive industry.

California Auto Outlook Report 2024 Cover Page

California Auto Outlook Report 2024 Cover Page

Tesla’s Dominance in the EV Market Faces Headwinds in New Car 2024

One of the most notable findings for new car 2024 is the continued decline of Tesla’s market share within the electric vehicle segment in California. The report reveals that Tesla experienced its fifth consecutive quarterly registration decline, with a 7.8 percent drop in Q4 2024. This contributed to an overall 11.6 percent decrease in registrations throughout 2024. Consequently, Tesla’s grip on the Zero Emission Vehicle (ZEV) market loosened, falling by 7.6 percentage points to 52.5 percent by the end of 2024. Looking at the broader California new car 2024 market, Tesla’s overall share decreased from 13 percent in 2023 to 11.6 percent in 2024, indicating a significant shift in consumer choices.

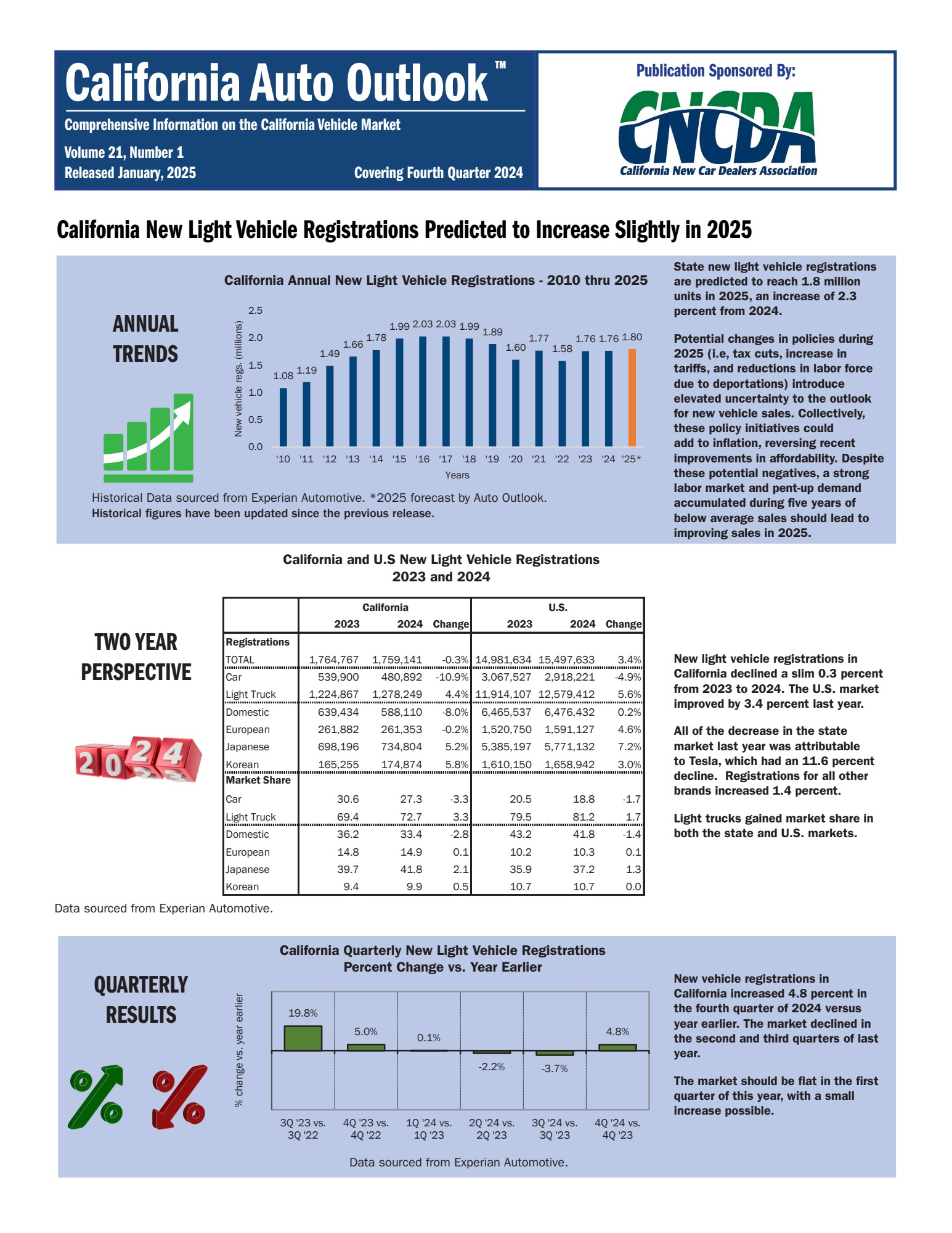

Stable Overall New Car 2024 Market with Optimistic Projections

Despite Tesla’s EV market challenges, the overall California new car 2024 market demonstrated stability. A total of 1,759,141 light vehicles were registered in the state, showing a marginal decrease of only 0.3 percent compared to 2023. Looking ahead, the report projects a positive trajectory for 2025, anticipating a slight increase in registrations to 1.80 million vehicles. The final quarter of 2024 showed promising momentum, with a 4.8 percent increase in new car 2024 registrations compared to Q4 2023, suggesting a potentially stronger market in the coming year. However, the report anticipates a relatively flat performance for the first quarter of 2025.

Hybrid Vehicles Surge as ZEV Market Share Dips in New Car 2024

A key trend identified in the new car 2024 report is a change in consumer preference within the alternative powertrain sector. The market share for all ZEV brands declined to 21.3 percent in Q4 2024, down from 23.7 percent in the previous quarter. However, the annual ZEV market share for California reached 22 percent, slightly up from 21.7 percent in 2023. Interestingly, while ZEV market share experienced a quarterly dip, registrations for all alternative powertrains reached 40.2 percent for the year and 42.2 percent in Q4. Notably, hybrid vehicles filled the gap left by ZEVs, increasing by 2.4 percentage points in Q4, mirroring the exact decline in ZEV registrations. This trend suggests that California consumers might be opting for a more gradual transition from traditional internal combustion engine (ICE) vehicles to fully electric options, with hybrids becoming an increasingly attractive intermediate choice in the new car 2024 market.

Robb Hernandez, CNCDA Chairman and owner of Camino Real Chevrolet, highlights this consumer-driven market: “As dealers, our primary goal is to offer the vehicles that Californians actually want to drive. Whether it’s hybrids, electric vehicles, or traditional models, we are here to meet consumer demand. It’s not about mandates or pushing one type of powertrain over another—it’s about having the right inventory on our lots to serve the needs of real customers and our communities.”

Toyota Leads Brand Market Share in California’s New Car 2024 Landscape

Analyzing brand performance in the new car 2024 California market, Toyota emerged as the leader across all powertrains, with 289,258 registrations in 2024, a 4.4 percent increase from the previous year. Toyota now holds a significant 16.4 percent share of the California market. Following Toyota in market share are Tesla and Honda, with Honda achieving a notable 11.5 percent increase in registrations in 2024, totaling 192,166 registrations. Several brands experienced substantial registration growth in 2024, including Lincoln (27.6 percent), Land Rover (22 percent), Cadillac (21.7%), and Buick (21.7 percent), indicating shifting brand preferences in the new car 2024 market.

Top Model Segments in California New Car 2024 Sales

The report also identifies the best-selling models in key segments for new car 2024 in California. The top performers included: Toyota Camry, Tesla Model 3, Honda Civic, Toyota Tacoma, Chevrolet Silverado, Toyota RAV4, Subaru Outback, and Lexus RX. In the passenger car segment, the Toyota Camry led the way with 11.4 percent market share, closely followed by the Honda Civic and Tesla Model 3, tied for second place with 11 percent market share each. For light trucks, the Tesla Model Y dominated with 128,923 registrations, followed by the Toyota RAV4 (65,041) and the Honda CR-V (49,920 registrations).

Regional Differences in California’s New Car 2024 Market

Examining regional variances within California’s new car 2024 market reveals interesting contrasts. Northern California witnessed a 12.6% decline in passenger car registrations but a 1.5% increase in light truck registrations. ZEVs accounted for 25.1% of the market share in Northern California. Southern California experienced a 10.3% decrease in passenger car registrations and a 5% increase in light truck registrations, with ZEVs representing 22.7% of the market share. These regional differences highlight varying consumer preferences and market dynamics within the state.

In Conclusion

The California new car 2024 Auto Outlook Report paints a picture of a stable yet evolving automotive market. While overall registrations remained consistent, the report underscores significant shifts in consumer preferences, particularly the slowdown in Tesla’s EV dominance and the growing appeal of hybrid vehicles. These trends suggest a nuanced and dynamic market where consumer choice and gradual transitions are shaping the future of California’s automotive landscape. The full EOY 2024 Auto Outlook Report offers deeper insights into these trends and is available for further exploration.