The California New Car Dealers Association (CNCDA) has released its Year End 2024 California Auto Outlook Report, providing a comprehensive analysis of vehicle registrations throughout the past year and forecasting trends for the new year. This report, relying on data from Experian Automotive, offers crucial insights for anyone following the automotive market, particularly concerning New 2024 Car sales and evolving consumer preferences.

California New Car Dealers Association Year End 2024 Auto Outlook Report Cover Page

California New Car Dealers Association Year End 2024 Auto Outlook Report Cover Page

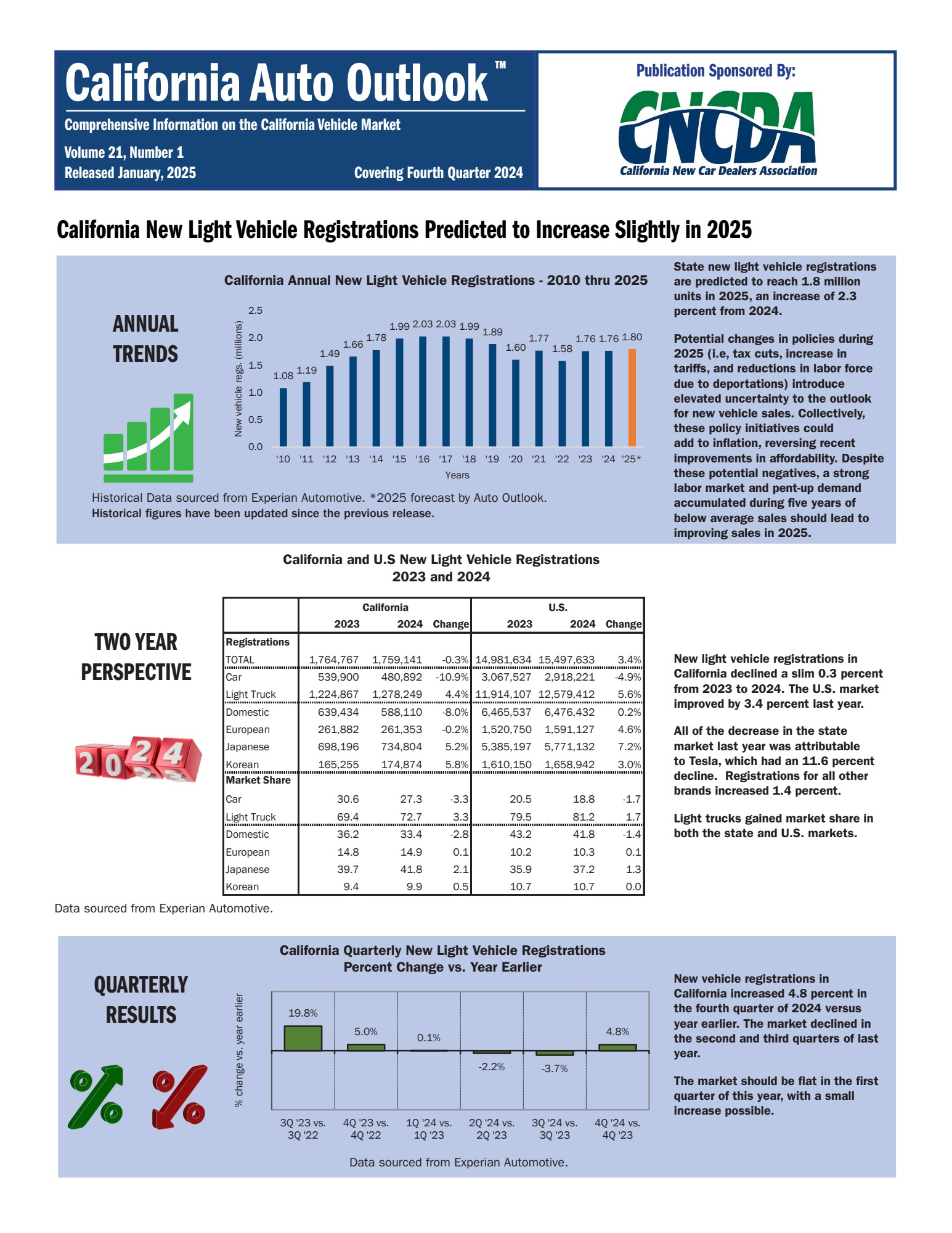

While the overall new car market in California remained remarkably stable in 2024, with a marginal decrease of just 0.3 percent compared to the previous year, the report highlights significant shifts beneath the surface. A total of 1,759,141 new light vehicles were registered in the Golden State. Looking ahead, the forecast for 2025 is optimistic, projecting a slight increase in registrations to 1.80 million vehicles. The final quarter of 2024 showed a promising 4.8 percent increase in new vehicle registrations compared to Q4 2023, suggesting positive momentum as we enter 2025, although the first quarter is anticipated to be relatively flat.

One of the most notable trends revealed in the 2024 car market is the changing dynamic within the alternative powertrain sector. Zero Emission Vehicles (ZEVs) experienced a dip in market share in the fourth quarter of 2024, falling to 21.3 percent from 23.7 percent in the previous quarter. However, the annual ZEV market share for California in 2024 reached 22 percent, slightly up from 21.7 percent in 2023, indicating a nuanced picture rather than outright decline for EVs across the year.

Interestingly, this slight slowdown in ZEV adoption was counterbalanced by a significant surge in hybrid vehicle registrations. Hybrids gained 2.4 percentage points in market share during Q4 2024, perfectly mirroring the ZEV market share decline. This trend suggests a potential shift in consumer behavior, with California car buyers possibly opting for a more gradual transition from traditional internal combustion engines (ICE) to fully electric vehicles. Hybrid technology is emerging as an increasingly attractive intermediate step for many. In total, alternative powertrains accounted for 40.2 percent of the market share for the entire year and 42.2 percent in Q4 alone, demonstrating the growing importance of vehicles beyond traditional gasoline engines in the new 2024 car landscape.

Tesla, a dominant force in the EV market, experienced its fifth consecutive quarterly registration decline. Tesla registrations decreased by 7.8 percent in Q4 2024, contributing to an overall 11.6 percent decrease throughout 2024. Consequently, Tesla’s market share in the ZEV sector reduced by 7.6 percentage points in 2024, although they still hold a majority share of 52.5 percent. Across the entire California new car market, Tesla’s share is now 11.6 percent, down from 13 percent in 2023, showing a softening grip on the market compared to previous years.

Despite these shifts, Toyota maintains its position as the leading brand in California’s new car market, registering 289,258 vehicles in 2024, a 4.4 percent increase from the prior year. Toyota now commands 16.4 percent of the California market share. Following Toyota, Tesla and Honda are the next leading brands with Honda achieving 10.9 percent market share and experiencing an impressive 11.5 percent increase in registrations in 2024, totaling 192,166 vehicles. Several brands demonstrated substantial registration growth exceeding 20 percent in 2024, including Lincoln (27.6 percent), Land Rover (22 percent), Cadillac (21.7%), and Buick (21.7 percent), indicating strong performance for these manufacturers in the new 2024 car market.

In terms of model segment rankings for the new 2024 car, the Toyota Camry led the passenger car segment, while the Tesla Model 3 and Honda Civic were closely tied for second. For light trucks, the Tesla Model Y was the top seller, followed by the Toyota RAV4 and Honda CR-V. These model rankings highlight the continued popularity of both established models and newer electric options in the California market.

Regional variations within California also present an interesting aspect of the 2024 car market. Northern California saw a notable 12.6% decline in passenger car registrations but experienced a 1.5% increase in light truck registrations. ZEVs accounted for a significant 25.1% of the Northern California market share. Southern California witnessed a similar trend, with passenger car registrations decreasing by 10.3% and light trucks increasing by 5%. ZEVs constituted 22.7% of the market share in Southern California, showing a slightly higher adoption rate of EVs in the northern part of the state.

In conclusion, the California 2024 new car market demonstrates overall stability but reveals significant underlying shifts in consumer preferences, particularly within the alternative powertrain sector. The rise of hybrids alongside a slight cooling in ZEV market share, coupled with Tesla’s declining registrations, paints a complex picture of evolving consumer demand. As Robb Hernandez, CNCDA Chairman, aptly stated, dealers are focused on providing the vehicles Californians want to drive, whether hybrid, electric, or traditional, emphasizing the importance of meeting real customer needs in the dynamic new 2024 car market.

Data Source: Experian Automotive.

Report Source: California Auto Outlook Quarterly by Auto Outlook, Inc. for CNCDA.